The Beamable Network isn’t just another DePIN project—it’s a proven, revenue-generating platform designed to transform how games are built and operated. With more than 90 live games, 150+ in the pipeline, and $3M in ARR, the demand is already established. What sets Beamable apart is how that demand directly fuels the value of the $BMB token.

A $35B+ Market Ripe for Disruption

Every year, game studios spend more than $35 billion on backend infrastructure. Today, that spend flows almost entirely to centralized cloud providers, who apply heavy markups (3–15 times) on compute and bandwidth.

Beamable.Network democratizes this market, enabling node operators to provide compute at enterprise-grade standards for a fraction of the cost. For developers, it means infrastructure that’s cheaper (>50% savings), faster (pre-built microservices), and more reliable (no single point of failure). For investors, it means real demand that scales naturally with every new player and every new game.

How $BMB Powers the Network

At its core, $BMB is the utility token that underpins Beamable.Network’s economic engine:

- Games Pay for Compute. Game studios pay for API calls and backend services in either $BMB or USDC.

- Node Operators Earn Rewards. Router, Worker, and Checker Nodes execute workloads and earn rewards for uptime and performance.

- Deflationary Buybacks. When studios pay in USDC, the protocol uses those fees to buy back $BMB on the open market, reducing circulating supply.

- Developer Royalties. Third-party developers who contribute mods and services earn ongoing royalties, all tracked on-chain.

This creates a system where network growth = token demand.

Designed for Token Value Accrual

Unlike speculative tokens, $BMB is structured for real, recurring utility:

- Staking Rewards: Node operators and delegates stake $BMB to secure the network and earn protocol rewards.

- Fee Incentives: Paying in $BMB means a 2% network fee vs. 15–20% in USDC—driving natural adoption.

- Buyback Mechanism: All USDC fees are recycled into $BMB buybacks, adding consistent buy pressure.

- Treasury-Driven Design: Instead of a burn-and-mint model, tokens flow into the Treasury, which recycles value back into staking rewards, ecosystem growth, and long-term sustainability—ensuring supply aligns with network demand.

Put simply, the more games and players use Beamable.Network, the more $BMB is bought back, staked, and taken out of circulation.

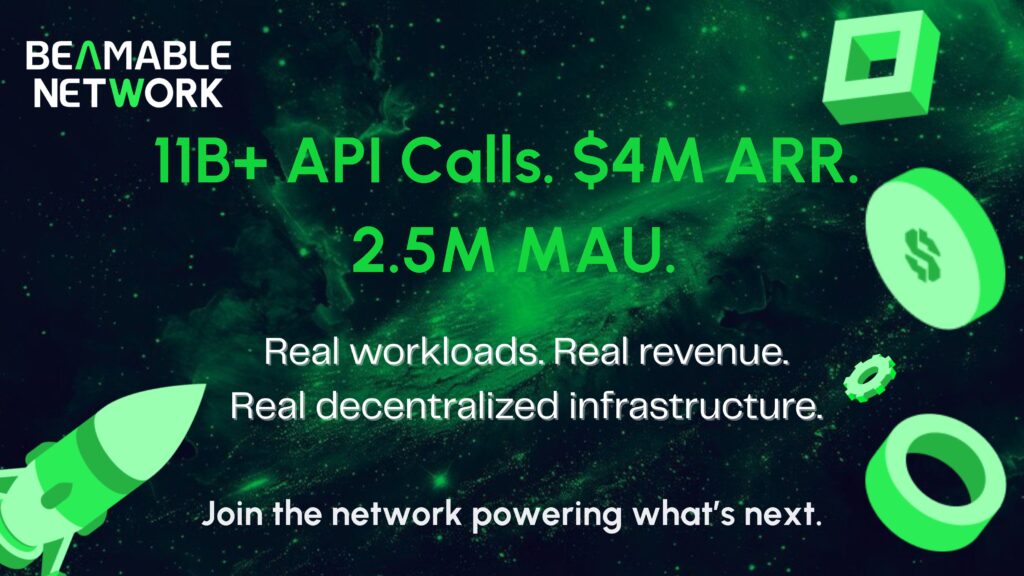

Proof of Traction

Beamable is already among the top 10 DePIN projects by ARR—and that’s before the full transition of 90+ live games and 150+ in the pipeline. With 186B API calls annually and a rapidly expanding developer base, the fundamentals are already in place for exponential growth.

Why This Matters for Investors

The combination of established demand, deflationary tokenomics, and a massive market opportunity positions Beamable.Network as one of the few DePIN projects where token value is directly tied to real-world utility.

Where most tokens hope to create future demand, $BMB already has it.

Join the conversation and help shape the future of decentralized game infrastructure: